Paying Your Pastor – A Dual-Tax Status Taxpayer…What???

Ordained, commissioned, or licensed pastors serving in a ministerial capacity are dual-status taxpayers – this means they are treated as an employee AND self-employed.

But practically speaking, what does this mean?

1. A church should never withhold FICA/Medicare taxes on their Pastor W-2.

The Pastor as self-employed must pay self-employment taxes (SECA). No dollar amount in Boxes 3, 4, 5, or 6 on their W-2. This is not a choice – the person functioning as a minister (see below) pays into the SECA system NOT the FICA system.

2. Pastors may have a portion of their compensation designated as housing allowance.

This amount must be designated by the church prior to payment and is exempt from federal income taxes for the pastor. This amount is never reported in Box 1 of the W-2. It may be noted in Box 14 if you like, but this is not mandatory.

3. Pastors are exempt from any mandatory federal income tax BUT…

…they may voluntarily request that the church withhold FIT. Some pastors request “extra withholding” on their W-4 to cover the SECA taxes they are going to have to calculate and pay. These amounts would go in Box 2 of the W-2

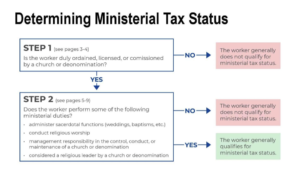

So how do you know if someone in your church qualifies as a pastor? This little guide might help.