Fraud: How It Happens and How to Prevent It

Thankfully it is becoming less taboo to discuss church fraud and embezzlement. It is crucial that we discuss these issues out in the open so that they are less likely to occur in the dark. With approximately 1 out of every 3 American churches experiencing theft (both on large and small scales) each year, church leadership need to consider what they can do to prevent this from occurring within their organization. And since most schemes last 18 months or more before being caught, this could be an issue for your church right now without even realizing it!

Common techniques for committing fraud include:

- Billing schemes

- Checks payable to cash

- Employee credit card expenditures that are not church-related

- Skimming from the offering plate

- Fictitious employee

- Discontinuing payments to credit card companies or the IRS but continuing to record payments being made

There are many other ways someone may be stealing from the church. While we do not want to look at every individual as a thief, it is important to be on the lookout for suspicious behavior. “Trust, but verify.”

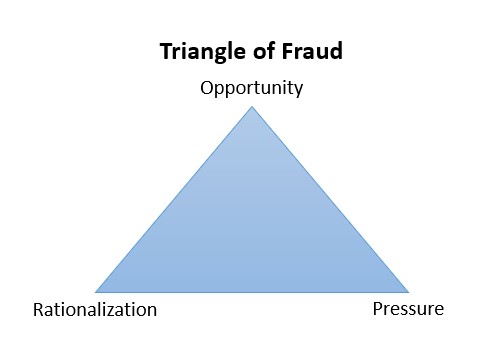

Why would someone steal from the church and therefore from God? Most of the time it starts in a way that feels innocent enough to the one stealing the funds. Perhaps he or she got into their own personal financial bind and they decide to “borrow” some money from the church with every intention to pay it back. Only, they fall even further behind financially and decide to “borrow” some more. They realize that nobody noticed or missed the funds and the cycle continues. Eventually they dig such a deep hole for themselves they could not possibly repay the debt. Other people may have malicious intent from the get-go. Some people feel that they deserve the money or are confident they can get away with it. Whatever their reasons, it certainly happens. And if the church that falls victim to these schemes does not put an end to and report the fraud, that person may end up moving on to another church to start the scheme over again.

The number one deterrent is the fear of getting caught. This is more frightening than prison time and more powerful than a guilty conscience. Therefore the more a person is trusted the more likely they are to be the next thief. No one should be above scrutiny when it comes to regularly auditing the activity of church staff and volunteers for signs of fowl play.

In order to increase the likelihood and therefore fear of getting caught, your church should have procedures in place for handling money. This includes having two counters each Sunday who are rotated regularly. We have many more tips for the proper handling of cash in our blog post dedicated to this topic.

Another huge way to deter fraud is to show your employees that you are keeping an eye on the church finances. Regularly reviewing credit card and bank statements, reconciling accounts, and requesting missing receipts will show your staff that you pay attention to their transactions. No church should be taking someone’s word for the balance of an account. Login credentials need to be issued to two or more individuals and they should each have their own login credentials so that there is a record of who accessed the account and who moved money around. Do not share logins to any account where funds can be moved or financial records manipulated or changed. Reviewing the financial statements monthly is crucial to preventing fraud from happening and catching it early should there be something amiss.

This may sound odd but mandatory vacations are another way to prevent fraud. If an employee is reluctant to take time off or delegate any of their tasks to another employee while on vacation, this should raise a red flag for church leadership.

Having a web-based accounting software is another way to prevent fraud from ever happening because web-based accounting software systems are more transparent and timely. Allowing one person to keep the financial records with pen and paper or on an Excel spreadsheet leaves a church extremely vulnerable. That type of record keeping can be easily manipulated or changed without leaving any record. A web-based or cloud-based software has an audit log of every single action ever taken in the software. If something gets changed or manipulated, there is a permanent paper trail. This is one reason people hire Bellwether Church Solutions as their bookkeeping partner. We handle all the receipts and reconciliations on a cloud-based software program that can be accessed by church leadership any time day or night for review. And for many employees, knowing a third party company such as Bellwether is reviewing the financials will deter them from malicious actions before they even start.

If you happen to notice an employee living a lifestyle out of line with their income (a fancy car purchase, designer handbag or clothes, extravagant vacations, etc.) this might raise a red flag. While their spouse may be funding this lifestyle, it does not hurt to take a closer look at the church financials and particularly at the tasks that individual may be in charge of just in case. If the employee takes up a gambling or drug habit, this is also a cause for concern (not just because of the employee’s well-being which is of course extremely important but because those types of behaviors may put the employee in a vulnerable place where they become desperate for money).

Requiring regular background checks and even credit checks is another practical step your church can take to help prevent fraud. This is a good practice for not just employees but elders, deacons, and volunteers.

Finally, the church should talk about and practice living moral lives in accordance with God’s Law. While the church was never meant to be a place for perfect people (quite the opposite — church is a place for broken people in need of a Savior), our goal as a church should be to hold each other accountable to living out a God-honoring life. It starts with the church leadership and trickles down to the staff and congregation.

If you catch someone stealing from the church:

- Call an attorney immediately

- Hire a Certified Fraud Examiner

- Do not confront them

- Do not discuss the issue publicly

- Prosecute when possible so that they cannot move onto another church and commit the same actions

Is your church taking the necessary steps to prevent fraud and embezzlement? What might your church do differently or better? You can take our FREE church bookkeeping quiz and receive a personalized report card from our Chief Facilitator, Lee Ann Crockett. This is a great starting point if you feel your church may need to tighten up policies and procedures regarding church resources. As you can probably tell by now, this is an issue we take seriously at Bellwether and we hope our clients and those who stumble upon our blog do the same.